The Laffer Curve is the visual conception of a theory developed by supply-side economist Arthur Laffer to show the relationship between marginal income tax rates and the amount of tax revenue collected by State governments. An economist, Mr. Laffer first gained prominence by serving on Ronald Reagan’s Economic Policy Advisory Board from 1981–89. The Curve was, and still is, used to illustrate Laffer’s main premise; the more an activity, or production, is taxed, the less of it is generated. More on that in a moment but, as described by David Stockman in his book, The Triumph of Politics, this is something President Ronald Reagan could relate to. As Stockman described it, “The Gipper” told over and over again, his story of how during World War II, he and his fellow actors would stop working after filming their fourth motion picture of the year. Why, you ask? Based on the amount of income they made per picture, they would be taxed on any additional, or marginal, income at the highest federal tax rate at the time, 94%. I’m not sure it takes an economist, in fact it did not as Ronald Reagan, an actor, understood it, to understand the concept of higher marginal tax rates leads to less production. None the less, Laffer’s theories have been somewhat controversial.

I personally believe that controversy has been misplaced. The theory, quite simply, states that State governments will collect zero taxes at marginal income tax rates of 0% or 100%. On one end, if income tax rates are zero the State obviously collects nothing. At 100%, there is no incentive, save threats, lashes, harsh punishment, for anyone to get out of bed in the morning. At some point in between 0% and 100%, Laffer theorizes, correctly, there is an optimal rate for the State in which they can maximize revenue while their subjects still find it worth their while to go to work every day. While the theory is sound, if not morally bankrupt, finding that optimal point along the Laffer Curve would, in the 1980’s, and will always, prove elusive.

According to their detractors, Laffer and his fellow supply-siders erred in concluding, in the 1970’s, that high marginal income tax rates were disincentivizing work, thus production, and ultimately produced less than optimal, lower, tax collections for the United States government. In short, they felt that marginal income tax rates were not only not too high, but that they were not high enough, to a point where total tax collections, again, were lower than what they would otherwise be under a regime of higher marginal income tax rates. What is important to realize is that the supply-siders, Republicans in general, and the Democrats, were all aligned in their interest to maximize revenues, taxes, for the federal government. The only question was how they would achieve this. The Republicans, ultimately falling in line with Laffer’s theory, claimed that lower marginal income tax rates would lead to greater tax revenues. Democrats took the traditional approach, that higher marginal income tax rates produce greater tax revenues.

Taken in isolation, that the (Laffer) theory is sound in concluding that there is an optimal point, elusive as that might be, at which any State can maximize their revenues through marginal income tax rates at the expense of their subjects is without question. In practice, however, it is highly unlikely that simply implementing marginal income tax reforms will lead to the intended tax revenue collection target. Ultimately, Laffer and his followers fail to account for, or account for incorrectly, political, economic, and financial, variables that remain completely out of their control. In other words, taking the 1980’s as an example, competing interests both in and outside the U.S. government made it difficult to implement and modify their plans, or isolate results specifically related to their policy prescriptions. A fairly comprehensive overhaul of the income tax code, including lower marginal income tax rates beginning in 1981, ensued. Did tax revenues increase as Laffer theorized? No, they initially declined. If you are familiar with the Reagan Presidency at all, you would understand that they did indeed cut tax rates, but economic activity and tax revenues following the tax cut declined sharply while spending and deficits ballooned. The result, however, was not a result of the theory itself.

By the time Ronald Reagan took office in January of 1981, the U.S. continued to reel from its worst period of consumer price inflation in modern memory. Double-digit inflation in the 1970’s was commonplace and eventually peaked at 14.8% in March of 1980. The Federal Reserve under Paul Volcker, who was elevated to the position of Chairman in 1979 by Jimmy Carter, raised the federal funds rate to 20% by June of 1981. That would be the peak, which lead to an ensuing recession, and brought consumer price inflation below 3% by 1983. It is impossible to say exactly what impact just this one event had, compared to the lower marginal income tax rates, on economic activity or the amount of tax revenues collected by the U.S. government, but when one considers the “success”, or not, of the Laffer Curve it would be foolish not to take account of such a monumental event in the history of the Federal Reserve and U.S. monetary policy.

In any event, many in the U.S. government did ignore this event and other factors, or discounted their overall impact. Instead, they claimed that marginal income tax rates were not too high in the 1970’s, instead that they were too low. Taxpayers, producers, they surmised, had not yet reached their pain threshold with regards to income taxes and that what Laffer and fellow supply-siders had really done was give the taxpayers a break when one was not warranted. Exactly how much tax pain a populace can withstand is yet, and will likely never be, known as we cannot simply isolate only a few variables in any complex economy. What I find astonishing and far more controversial, however, is why a self-proclaimed conservative and libertarian, Laffer, was consulting with the U.S. government on how to extract the most resources from the population. Whether he understood this or not, I do not know, but Laffer’s analysis and his theories are simply a modern adaptation of ancient theories, used through the millennia, to maximize the production of slave labor.

There are two ways in which to earn a living; through free markets, or through political means. Free markets involve voluntary contractual relations between buyers and sellers. Political means are varied and more complex. Advancing ones living politically might include conscripting labor under your dominion for conquest, infrastructure, or monuments. It might mean bribing politicians or, conversely, extorting business interests, who have the power to lead legislation. Perhaps a monopoly privilege or securing government contracts? Or, simply, it might include taxing the populace, well, just because. No matter the method, the political means is parasitic. State governments produce nothing without a host. Mr. Laffer’s aha moment was realizing; if we kill the host we, the parasites, die! Ought there not be a formula for determining exactly how much we, the parasites, can extract from the host, not only to continue to survive, but to thrive? To maximize what we, the parasites, can draw from the host and, thus, maximize our own growth, wealth, and well-being?

…the coercive, exploitative means is contrary to natural law; it is parasitic, for instead of adding to production, it subtracts from it. The “political means” siphons production off to a parasitic and destructive individual or group; and this siphoning not only subtracts from the number producing, but also lowers the producer’s incentive to produce beyond his own subsistence. In the long run, the robber destroys his own subsistence by dwindling or eliminating the source of his own supply.

Rothbard, Murray N., The Anatomy of the State (LvMI) (Kindle Locations 93-96). Ludwig von Mises Institute. Kindle Edition.

Murray Rothbard could not have said it better. Nor could there be any more just beginning to a more thorough analysis of the Laffer Curve. The concept, named for its “inventor”, and I use that term very loosely, is thousands of years old. Whether it be pharaohs, kings, despotic rulers, plantation owners, or democratic fascist republics, the political class realize, though it takes some longer than others, that their subjects are worth more to them alive than dead. That an economist who served in the White House under a supposed market-friendly President would have the nerve and audacity to actually spell this out in income tax policy is groundbreaking, even if his findings were neither groundbreaking nor the least bit original. It is simply more profitable to milk the cow slowly, than slaughter the cow all at once.

The original liberty of the tribe or the peasantry thus falls victim to the conquerors. At first, the conquering tribe killed and looted the victims and rode on. But at some time the conquerors decided that it would be more profitable to settle down among the conquered peasantry and rule and loot them on a permanent and systematic basis. The periodic tribute exacted from the conquered subjects eventually came to be called “taxation.” And, with equal generality, the conquering chieftains parceled out the land of the peasantry to the various warlords, who were then able to settle down and collect feudal “rent” from the peasantry. The peasants were often enslaved, or rather enserfed, to the land itself to provide a continuing source of exploited labor for the feudal lords.

Rothbard, Murray N., For a New Liberty: The Libertarian Manifesto (LvMI) (p. 78). Ludwig von Mises Institute. Kindle Edition.

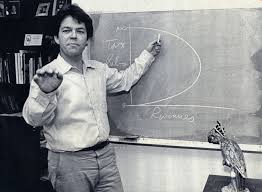

For emphasis, and to be totally clear, the Laffer Curve is designed to maximize wealth confiscation for the State, most famously and particularly the one that controls the U.S. government, not increase the wealth of the inhabitants of the nation. The politicians, bureaucrats, and their privileged suitors get wealthy, not the people. They must work longer and harder. If you were an ancient Egyptian pharaoh and commanded tens of thousands of slaves who spent their time erecting pyramids and other monuments, you understood that failing to supply water and food, or working them too hard, lead to inconvenient deaths. They did not need the Laffer Curve. Inconvenient deaths slowed down projects and required more war to procure more slaves. All time, for the slaves, that could be better spent building you a pyramid. They worked their slaves hard, but not too hard. Graphically, visually, Mr. Laffer settled on the following:

At some theoretical point the marginal rate of income taxation, represented on the y-axis, or vertical axis, becomes counter-productive. Rates of marginal income taxation beyond a certain point would diminish the desire of the subjects to work such that State revenues would decline. Apparently, such a tragedy for Mr. Laffer, that he decided to make a career out of his “revelation”. He, however, was not finished. Set the rate of marginal income taxation too low, below where the populace might hint at rebellion or an all out work stoppage, and an enterprising State government might be so callous as to leave money in the pockets of their subjects. If only they had set the marginal income tax rate higher, no such “problem” would exist. Government revenues are depicted on the x-, or horizontal, axis. Were we to advise a pharaoh in ancient Egypt, or a plantation owner in the Antebellum south, how might we modify the Laffer Curve? You could place hours worked on the vertical axis, and monuments and agricultural production, respectively, on the horizontal axis. Doesn’t it feel good to assist slave owners?

Assuming State governments could, and I have no doubt they are trying to, maximize their revenues via the Laffer Curve, it is important to note that, theoretically and practically, they can only keep their tax revenues at the zenith of the Laffer Curve under the following conditions;

- if other State governments maintain their marginal income tax rates, or total tax regimes, at the same, or a similar, level,

- through sheer brute force, threat of or actual violence, military enforcement of a national border and/or physical walls, or

- both.

It only stands to reason that the more a slave owner pushes the envelope, the more they try to extract and maximize profitability of their subjects, the more those subjects will entertain thoughts of escape. An equally high tax regime in neighboring jurisdictions might be the only force or wall required. As soon as one, or most likely several, State governments reduce their total tax regimes well below this point, or eliminate taxes all together, eventually all capital, human and otherwise, will re-circulate to the lower tax or no-tax jurisdictions. It only stands to reason, if you can live in a completely voluntary jurisdiction where taxation is treated like any other crime, people would be attracted to that. You see this play out today in the U.S. where states can compete via taxation and where businesses close their doors in high-tax states and migrate to low-tax states. The Soviet Union pushed the Laffer Curve to its maximum, even too far as incentives eventually were, beyond subsistence and threat of violence, completely destroyed.

To conclude, let me address what might be a complaint of Mr. Laffer, or supporters of supply-side theory, regarding the positions I have outlined. I cannot be sure, but they might claim that their goal with the Laffer Curve was two-fold, and that I have focused on only one half of the total picture, only briefly eluding to the other half. Yes, they might admit, that they were, and still are, attempting to maximize State revenues, but only through higher production. That lower marginal income tax rates would provide the necessary incentive for taxpayers to increase their production, and increase their wealth, along with those intimately connected to the State. This position would ignore one very important point; if lower marginal income tax rates increase incentives, why not recommend a rate of 0%? Or, 1%, maybe 2%? Mr. Laffer could have spent much more time combing through federal government budgets, recommending the elimination of entire agencies, reducing wasteful spending in programs deemed by him to be worthy (in my estimation a very short list) and otherwise insuring that marginal and total taxes were as low as they could possibly be. In favor of voluntary contractual market-based funding solutions, he could have advocated for elimination of the income tax all together.

To bring us full circle, if actor Ronald Reagan produced only four motion pictures at a top marginal income tax rate of 94%, but would have produced five at a marginal income tax rate of 50%, six at a top rate of 25%, or seven at a rate of 10%, why would we not lower the top income tax rate to 10%, or even less? Movies are, perhaps, a luxury or unnecessary item. What if we applied this same logic to other goods; like capital equipment and machinery, houses, vehicles, clothing, electronics, or even food? Would we not have more of all of these goods? If the national State, the U.S. government, were smaller, we would indeed. Let’s forget about money and material wealth for a moment. Let’s say that actor Reagan wanted to stop at four motion pictures per year, regardless of the top marginal income tax rate. What if he wanted to spend more time with his family, not make more movies? Would he have not had more wealth and more time with his family at a top rate of 25%, 10%, or lower, instead of 50%, or 94%? Of course he would. Every one of us not intimately connected and privileged through State power would have more wealth and/or more time with our friends and loved ones if the U.S. government, or any State government, confiscated less of what we produced. Why are we robbed of this opportunity? Because State government revenues, and the wealth of those connected to said State, would not be maximized. For this, we must thank, at least in part, Arthur Laffer, and the Laffer Curve.